$200,000

Hobart, TAS 7000

Professional

AIRBNB PROPERTY INVESTMENT . UNIQUE INVESTMENT. RETIRE IN ONE YEAR

Phone enquiries - please quote property ID 31393.

If you are earning a regular income and have borrowing capacity you can retire in one year. In the 37cts tax bracket, double your income in one year @ $120,000 per year. In the 45cts tax bracket, we can retire you @ $180,000 per year.

Housing Affordability Tasmania Pty Ltd is a business providing affordable rental accommodation as well as Airbnb. We have recently decided that it is more profitable to invest as tenants in common in equal shares rather than a company.

We have 2 investments available @ $205,000 each

1. Geeveston Development

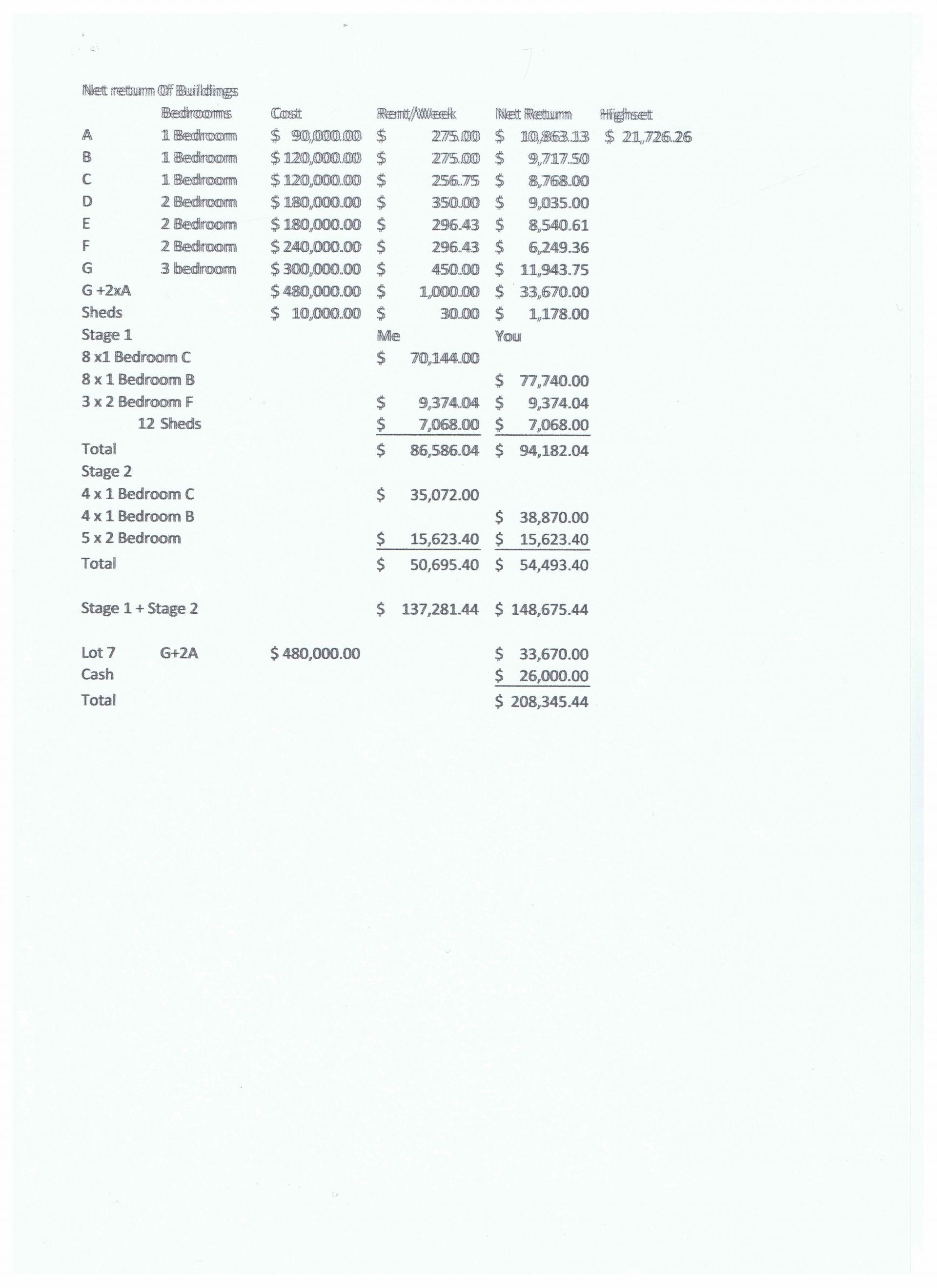

Unencumbered acreage block of 8094m2 to build 32 units ( 24 x 1 Bedroom + 8 x 2 Bedroom). This property has a council valuation of $170,000, is zoned Village and because of the 32 properties that can be built on it , we have estimated the value @ $15,000 per building or $480,000

We have to construct a road and infrastructure estimated to cost $120,000.

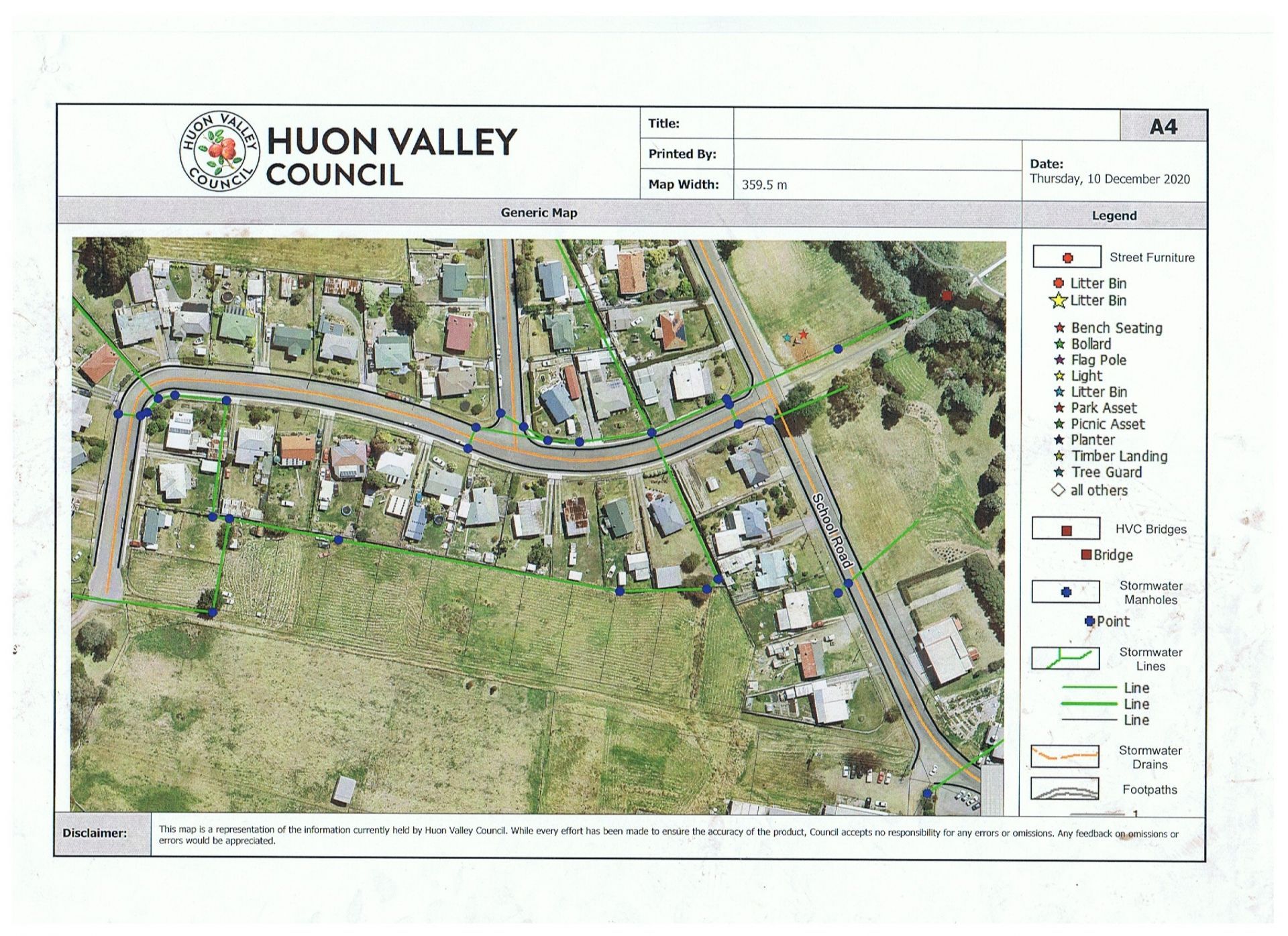

We will then build on the acreage block in 2 stages ( with some sub-stages)

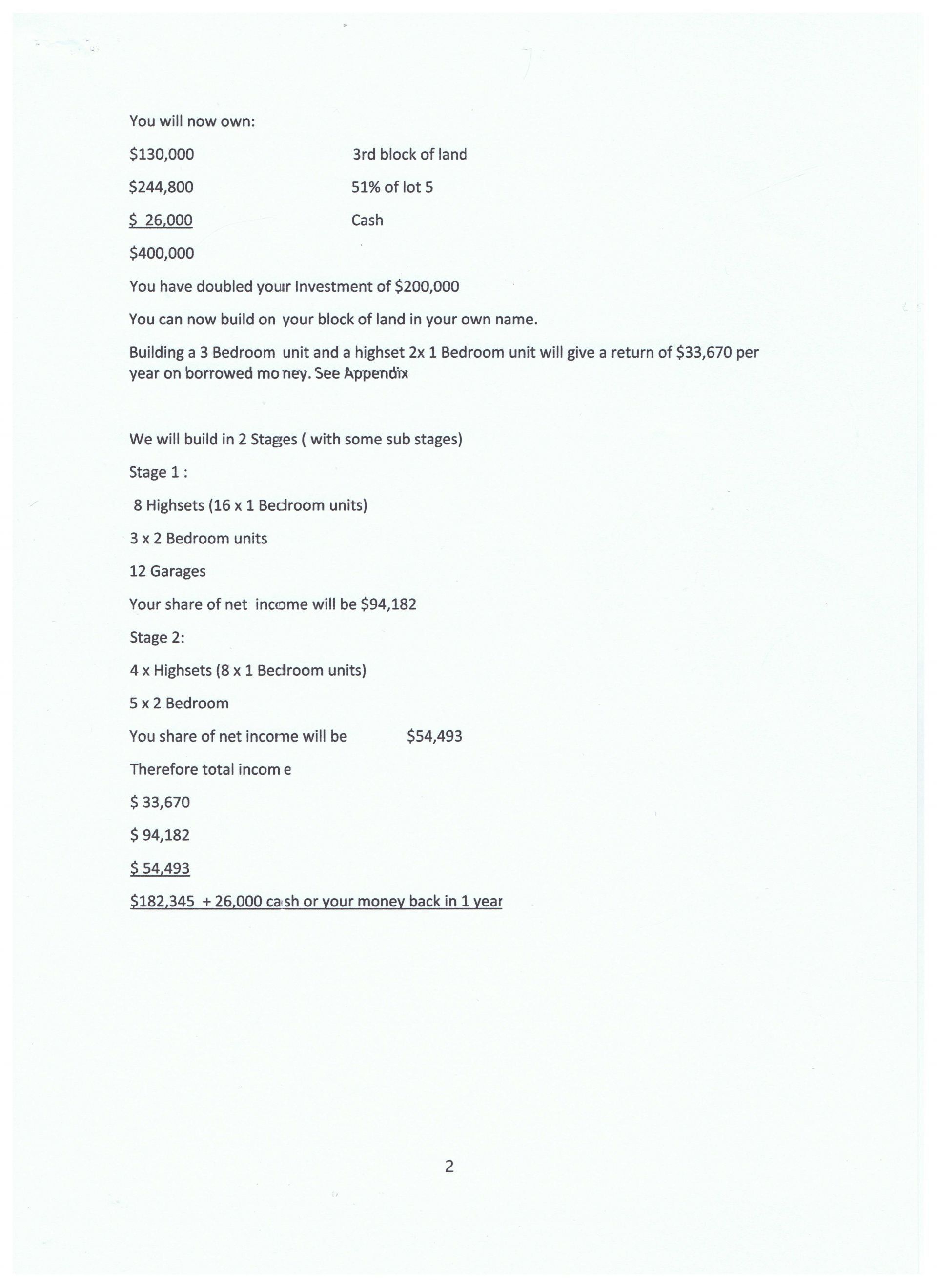

Stage 1 will be 16 x 1-bedroom units , 3 x 2-bedroom units and 12 garages with a net income on borrowed money of $94,182 per partner.

Stage 2 will be 8 x 1 Bedroom and 5 x 2 Bedroom for a net return of $54,493 per partner

The total return of the partner $148,674 .

Income can be enhanced if some of the units are used for Airbnb.

St Marys

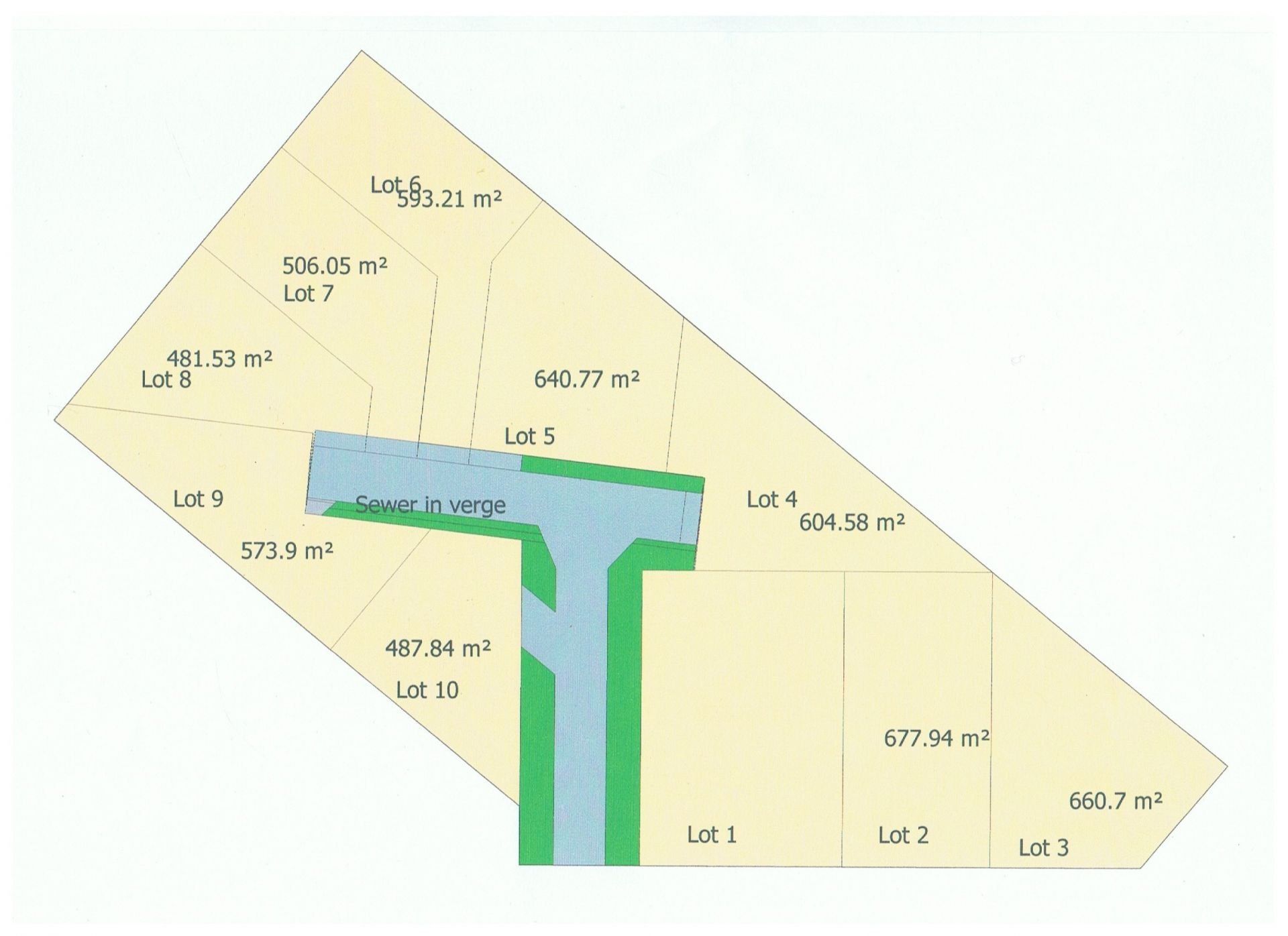

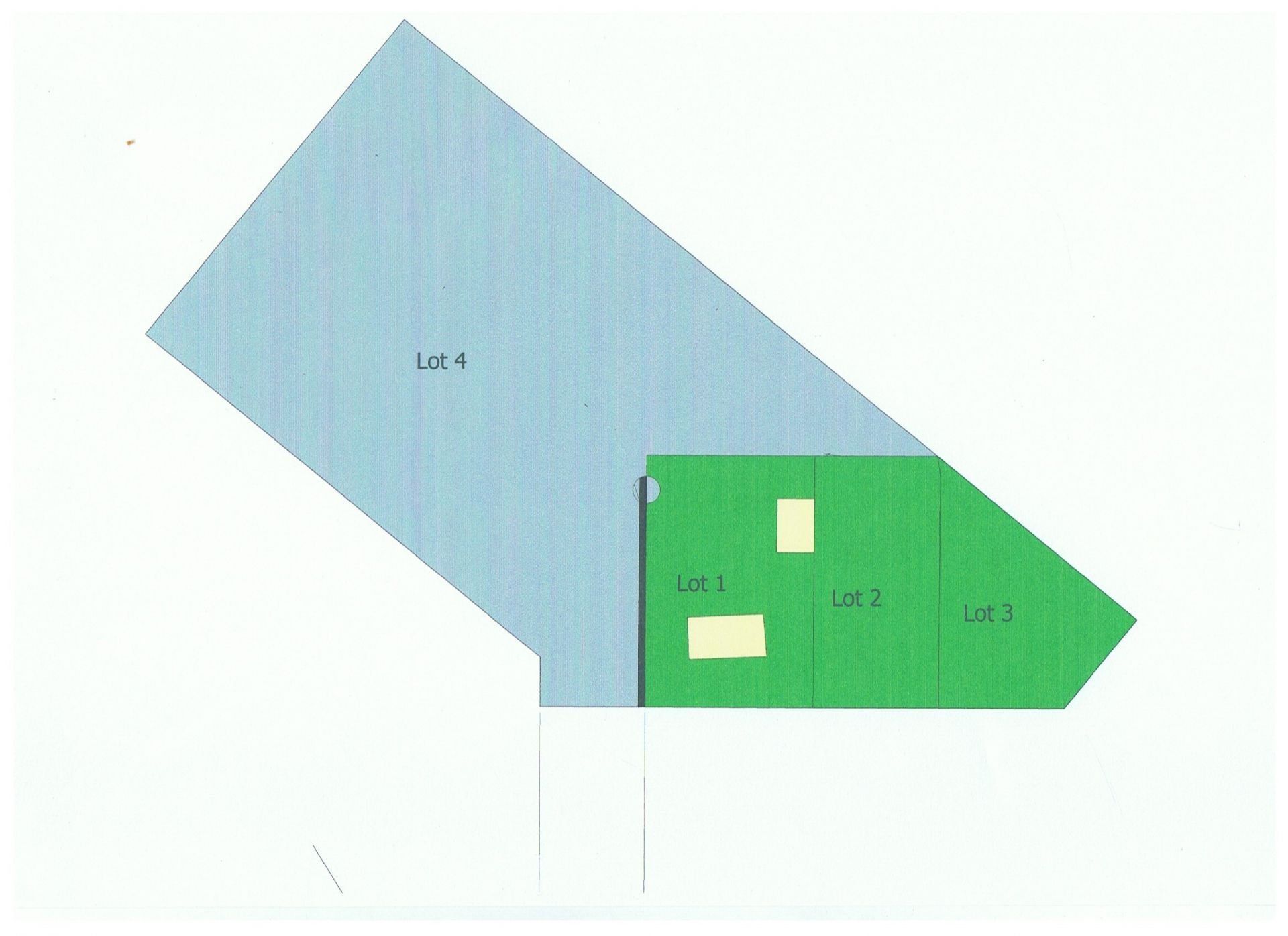

A property of 8094m2 with house, capable of being subdivided into 10 blocks.

Total initial development cost is $410,000 or $205,000 per partner as tenants in common in equal shares

My share of $205,000 has been contributed

The partner's share will be used to pay out an existing loan of $150,000 + $65,000 for the initial subdivision into 4 lots. We have a contract of $250,000 for lot 1 ( including house) and net proceeds of $240,000 will be distributed to the partners so that the total cash contribution is reduced to $85,000 per partner. Lot 2 is on the market for $135,000 and when sold helps to build on lot 3.

Lot 4 can be further subdivided into 7 lots at a cost of the sale of one of the lots.

So 3 lots to be sold and 7 retained at a net return of $34,588 per lot on 100% borrowed money. (Google : hat.house )

Income can be enhanced if used as Airbnb.

DISCLAIMER No Agent Business (www.noagentbusiness.com.au) is an Australian For Sale By Owner website operating since 1999. We proudly assist business owners who are looking to sell their own business without paying any broker commission. While every care has been taken to verify the accuracy of the details in this advertisement, the correctness cannot be guaranteed.

If you are earning a regular income and have borrowing capacity you can retire in one year. In the 37cts tax bracket, double your income in one year @ $120,000 per year. In the 45cts tax bracket, we can retire you @ $180,000 per year.

Housing Affordability Tasmania Pty Ltd is a business providing affordable rental accommodation as well as Airbnb. We have recently decided that it is more profitable to invest as tenants in common in equal shares rather than a company.

We have 2 investments available @ $205,000 each

1. Geeveston Development

Unencumbered acreage block of 8094m2 to build 32 units ( 24 x 1 Bedroom + 8 x 2 Bedroom). This property has a council valuation of $170,000, is zoned Village and because of the 32 properties that can be built on it , we have estimated the value @ $15,000 per building or $480,000

We have to construct a road and infrastructure estimated to cost $120,000.

We will then build on the acreage block in 2 stages ( with some sub-stages)

Stage 1 will be 16 x 1-bedroom units , 3 x 2-bedroom units and 12 garages with a net income on borrowed money of $94,182 per partner.

Stage 2 will be 8 x 1 Bedroom and 5 x 2 Bedroom for a net return of $54,493 per partner

The total return of the partner $148,674 .

Income can be enhanced if some of the units are used for Airbnb.

St Marys

A property of 8094m2 with house, capable of being subdivided into 10 blocks.

Total initial development cost is $410,000 or $205,000 per partner as tenants in common in equal shares

My share of $205,000 has been contributed

The partner's share will be used to pay out an existing loan of $150,000 + $65,000 for the initial subdivision into 4 lots. We have a contract of $250,000 for lot 1 ( including house) and net proceeds of $240,000 will be distributed to the partners so that the total cash contribution is reduced to $85,000 per partner. Lot 2 is on the market for $135,000 and when sold helps to build on lot 3.

Lot 4 can be further subdivided into 7 lots at a cost of the sale of one of the lots.

So 3 lots to be sold and 7 retained at a net return of $34,588 per lot on 100% borrowed money. (Google : hat.house )

Income can be enhanced if used as Airbnb.

DISCLAIMER No Agent Business (www.noagentbusiness.com.au) is an Australian For Sale By Owner website operating since 1999. We proudly assist business owners who are looking to sell their own business without paying any broker commission. While every care has been taken to verify the accuracy of the details in this advertisement, the correctness cannot be guaranteed.

Property Info

Municipality

Hobart

Thank You

Your enquiry has been sent!

Enquiry is Failed

Please contact your administrator.